where's my unemployment tax refund 2020

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. President Joe Biden signed the pandemic relief law in.

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

The American Rescue Plan Act which was signed on March 11 included a 10200 tax exemption for 2020 unemployment benefits.

. The American Rescue Plan Act waived federal tax on up to 10200 of 2020 unemployment benefits per person. On Nov 1 the IRS announced that it had issued approximately 430000 tax refunds to taxpayers who overpaid taxes on their unemployment benefits in 2020. If the IRS continues issuing refunds they will go out as a direct deposit if you provided bank account information on your 2020 tax return.

Another way is to check. The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billion. If you paid taxes on your unemployment benefits from 2020 and filed your return before the American Rescue Plan was passed in March you could be getting a refund this.

You reported unemployment benefits as income on your 2020 tax return. The tax agency says it recently sent. The IRS will send out the extra refunds via direct deposit starting on Wednesday July.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000. The link is in the Group Announcements. ARPA allows eligible taxpayers to exclude up to 10200 of.

People might get a refund if they filed their returns. The IRS has sent 87 million unemployment compensation refunds so far. Thats the same data the IRS released on November 1.

We have a sister site for all Unemployment questions. Ad See How Long It Could Take Your 2021 State Tax Refund. How To Check Your Irs Transcript For Clues About Your Refund.

You did not get the unemployment exclusion on the 2020 tax return that you filed. The IRS moved quickly to implement the provisions of the American Recovery Plan Act ARPA of 2021. How To Call The Irs If Youre Waiting On A Refund.

ARPA excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020. A page for taxpayers to share information and news about delays IRS phone numbers etc. If you received unemployment benefits in 2020 a tax refund may be on its way to you.

Its best to locate your tax transcript or. The pandemic and all the changes to tax laws because of it have really thrown a wrench in the IRS being able to get refunds out as fast as they used to. Taxpayers should not have been taxed on up to 10200 of the.

Since May the IRS has been making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who. This summer the IRS started making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who qualify for a 10200 unemployment tax break. The IRS has estimated that up to 13 million Americans may qualify.

Unemployment tax refund. The law waived taxes on up to 10200 in 2020 unemployment insurance benefits for individuals who earn less than 150000 a year. The IRS says eligible individuals shouldve received Form 1099-G from their state unemployment agency.

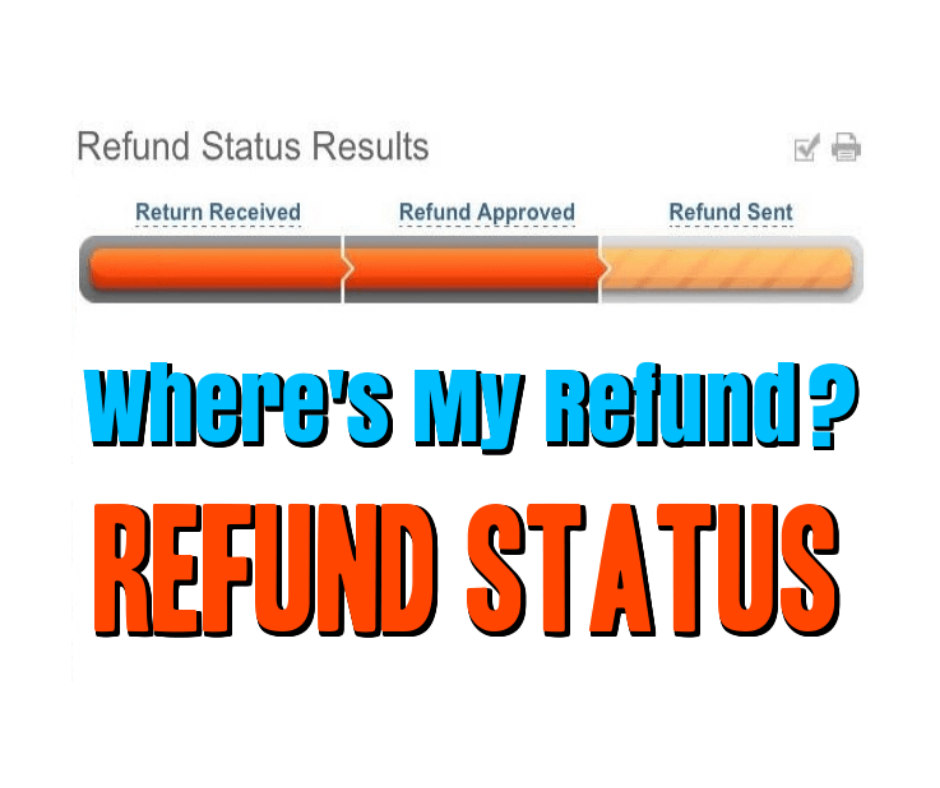

The 2021 tax year might rapidly be drawing to a close but the Internal Revenue Service is still busy issuing refunds to people for 2020. The unemployment exclusion would appear as a negative amount on Schedule 1 line. A direct deposit amount will likely show up as IRS TREAS 310 TAX REF.

The average refund this time around is 1265 according to a Tuesday news release. Congress made up to a 10200 in jobless benefits payment in 2020 tax-free for people earning less than 150000 a year. The refund will go out as a direct deposit if you provided bank account information on your 2020 tax return.

You did not get the unemployment exclusion on the 2020 tax return that you filed. What are the unemployment tax refunds. Otherwise the IRS will mail a paper check to the address it has on.

Otherwise the refund will be mailed as a paper check to whatever address the IRS has on hand. Check your refund status. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset the debt.

Where S My Refund Where S My Refund Status Bars Disappeared We Have Gotten Many Comments And Messages Regarding The Irs Where S My Refund Tool Having Your Orange Status Bar Disappearing This Has

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Where S My Refund Home Facebook

Where S My Refund Of North Dakota Taxes

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Where S My Refund 2020 2021 Tax Refund Stimulus Updates

Where S My New York Ny State Tax Refund Ny Tax Bracket

Tax Refund Timeline Here S When To Expect Yours

Where Is My Money Smokey Where Is My Money Tax Refund Unemployment

Where S My Refund California H R Block

Tax Refund Status Is Still Being Processed

Where S My Refund Pennsylvania H R Block

Refund Status Where S My Refund Tax News Information

Composing A Financial Contingency Plan Taxes Humor Emergency Fund Financial

Tax Refund Status Is Still Being Processed

Where S My Refund Home Facebook

Where S My Refund Taxpayers Still Waiting For 2020 Irs Return Abc11 Raleigh Durham